EPFO teams up with 15 additional banks empanelled for collection of EPFO contributions taking total number to 32 banks

Apr 01, 2025

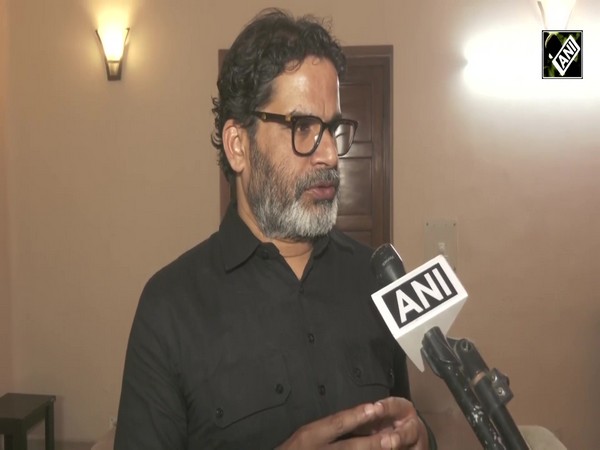

New Delhi [India], April 1 : Employees' Provident Fund Organisation (EPFO) entered into agreements with 15 additional public and private sector banks in the presence of Dr Mansukh Mandaviya, Union Minister for Labour & Employment, Youth Affairs & Sports in New Delhi on Tuesday.

The newly empanelled 15 banks will enable direct payment of nearly Rs 12,000 Crore in annual collections and enable direct access to employers who maintain their accounts with these banks. For enabling employers covered under the Act to pay their monthly contributions, EPFO has already empanelled 17 banks, taking the total to 32.

Union Minister of Labour & Employment and Youth & Sports, Dr Mansukh Mandaviya, in his address, stated that the country's progress towards a "Naya Bharat" is being significantly supported by institutions like the EPFO, which plays a crucial role in shaping the nation's future. With nearly 8 crore active members and more than 78 lakh pensioners, EPFO provides benefits that ensure social security for millions, he added.

He emphasised how EPFO continues to evolve and adapt, with the recent implementation of EPFO 2.01, a robust IT system that has significantly improved claim settlements. He said in the Financial Year 2024-25, EPFO settled record over 6 crore claims, a 35 per cent increase compared to the 4.45 crore claims settled in the previous year (2023-24).

Dr Mandaviya pointed out that customer satisfaction has risen significantly, and EPFO is actively working on evolving towards EPFO 3.0 to make it as accessible and efficient as banks.

He said that a significant milestone was also marked with the introduction of the Centralized Pension Payment System.

"This system will benefit over 78 lakh pensioners, enabling them to receive their pensions in any bank account across the country. Previously, pensioners were required to have an account in a specific zonal bank, this compulsion has now been removed," Union Minister explained.

Mandaviya also touched upon the significant reforms EPFO has introduced recently. "Auto claim settlement process is a major reform which has improved claim processing speed. With auto-processing, claims are now being settled in just three days. In FY 2024-25, we settled 2.34 crore claims under this system, a 160 per cent increase from the 89.52 lakh claims in 2023-24", Union Minister said.

Union Minister expressed happiness that EPFO is offering 8.25 per cent interest rate to its beneficiaries. The participation of banks in service delivery would further enhance efficiency of EFFO and improve good governance.

The new banks added by the EPFO are HSBC Bank, Standard Chartered Bank, Federal Bank, IndusInd Bank, Karur Vysya Bank, RBL Bank, South Indian Bank, City Union Bank, IDFC First Bank, UCO Bank, Karnataka Bank, Development Bank of Singapore, Tamilnad Mercantile Bank, Development Credit Bank and Bandhan Bank.